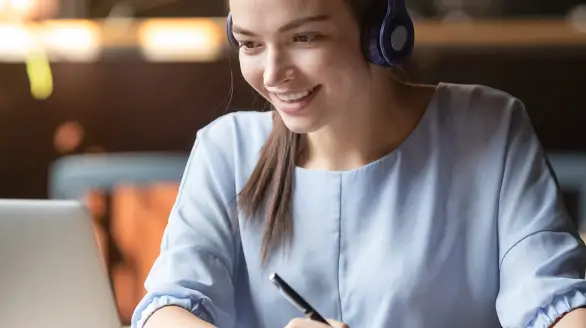

A State of the Art

e-Learning Experience

We provide a state of the art online learning platform, accessible from anywhere, learning available 24/7.

-

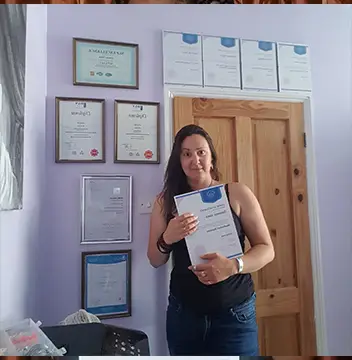

Access Your Personalised Course Library

View your courses in your online course library.

-

On-the-go Learning

Learn on your mobile, tablet, laptop or via audio.

-

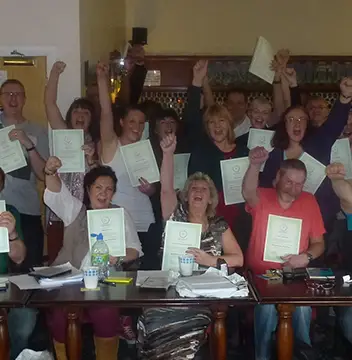

Join our thriving online community

Over 1 million learners.

-

Lifetime access

Learn in your own time at your own pace.